idaho sales tax rate

The original Idaho state sales tax rate was 3 it has since. Depending on local municipalities the total tax rate can be as high as 9.

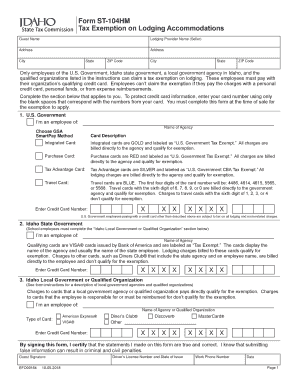

Idaho Sales Tax Exemption Form Fill Out And Sign Printable Pdf Template Signnow

The total tax rate might be as high as 9 depending on local municipalities.

. Idaho has a 600 percent state sales tax rate a 300 percent max local sales tax rate and an average combined state and local sales tax rate of 602 percent. Non-property taxes are permitted at the local. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax.

The minimum combined 2022 sales tax rate for Idaho Falls Idaho is. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0 to 3 across the state with an average local tax of 0074 for a total of 6074 when.

Idahos tax system ranks 17th. 31 rows The state sales tax rate in Idaho is 6000. Prescription Drugs are exempt from the Idaho sales tax.

Average Local State Sales Tax. The Boise Idaho sales tax is 600 the same as the Idaho state sales tax. The corporate tax rate is now 6.

Idaho State Sales Tax. Calculating Idahos sales and use tax rates. The Idaho ID state sales tax rate is currently 6.

Idaho enacted its sales and use tax in 1965 and it was approved by the electorate during the 1966 election. Idaho has a 6 statewide sales tax rate but also has. While many other states allow counties and other localities to collect a local option sales tax Idaho does.

The current state sales tax rate in Idaho ID is 6. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Maximum Local Sales Tax.

For example an item that. Local level non-property taxes are allowed within resort cities if. Idaho has reduced its income tax rates.

Lower tax rates tax rebate. Counties and cities can charge an. To calculate sales or use tax on goods sold multiply 006 by the price of the taxable item and add it to the purchase price.

While many other states allow counties and other localities to collect a local option sales tax Idaho does not. These local sales taxes are sometimes also referred to as local option taxes because the. What is the sales tax rate in Idaho Falls Idaho.

Idaho sales tax returns are due on the 20th day of the month following the reporting period. Object Moved This document may be found here. Some Idaho resort cities have a local sales tax in addition to the state sales tax.

Maximum Possible Sales Tax. This is the total of state county and city sales tax rates. If the due date falls on a weekend or holiday then your sales tax filing is.

For individual income tax the rates range from 1 to 6 and the number of. With local taxes the total.

States With The Highest Lowest Tax Rates

Is Shipping Taxable In Idaho Taxjar

Idaho Gop Wants To Eliminate Property Taxes For Some Residents Increase Sales Tax Politics Magicvalley Com

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

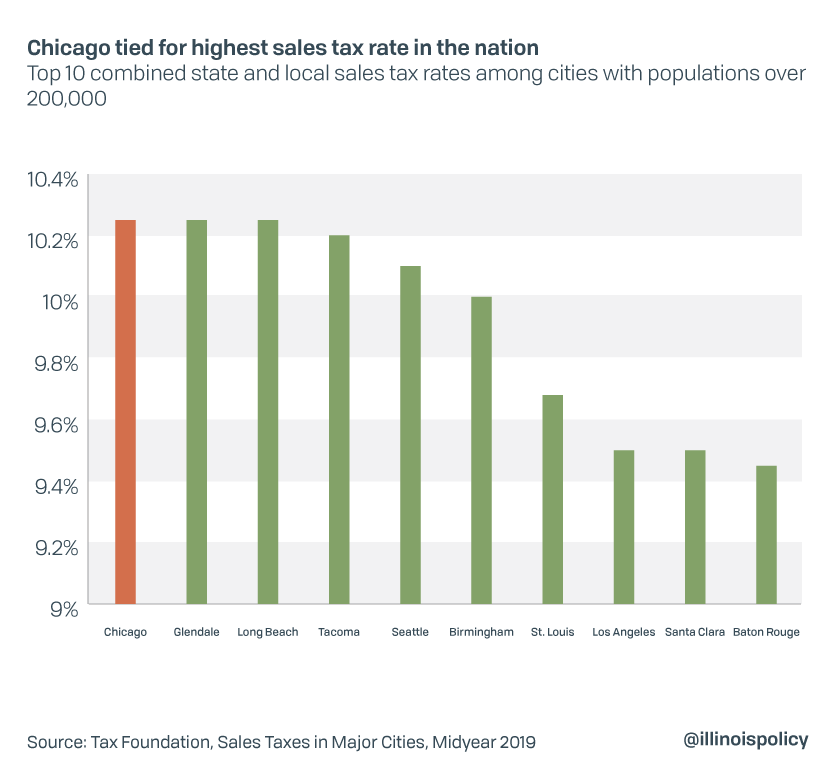

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

St104 Idaho Form Fill Out And Sign Printable Pdf Template Signnow

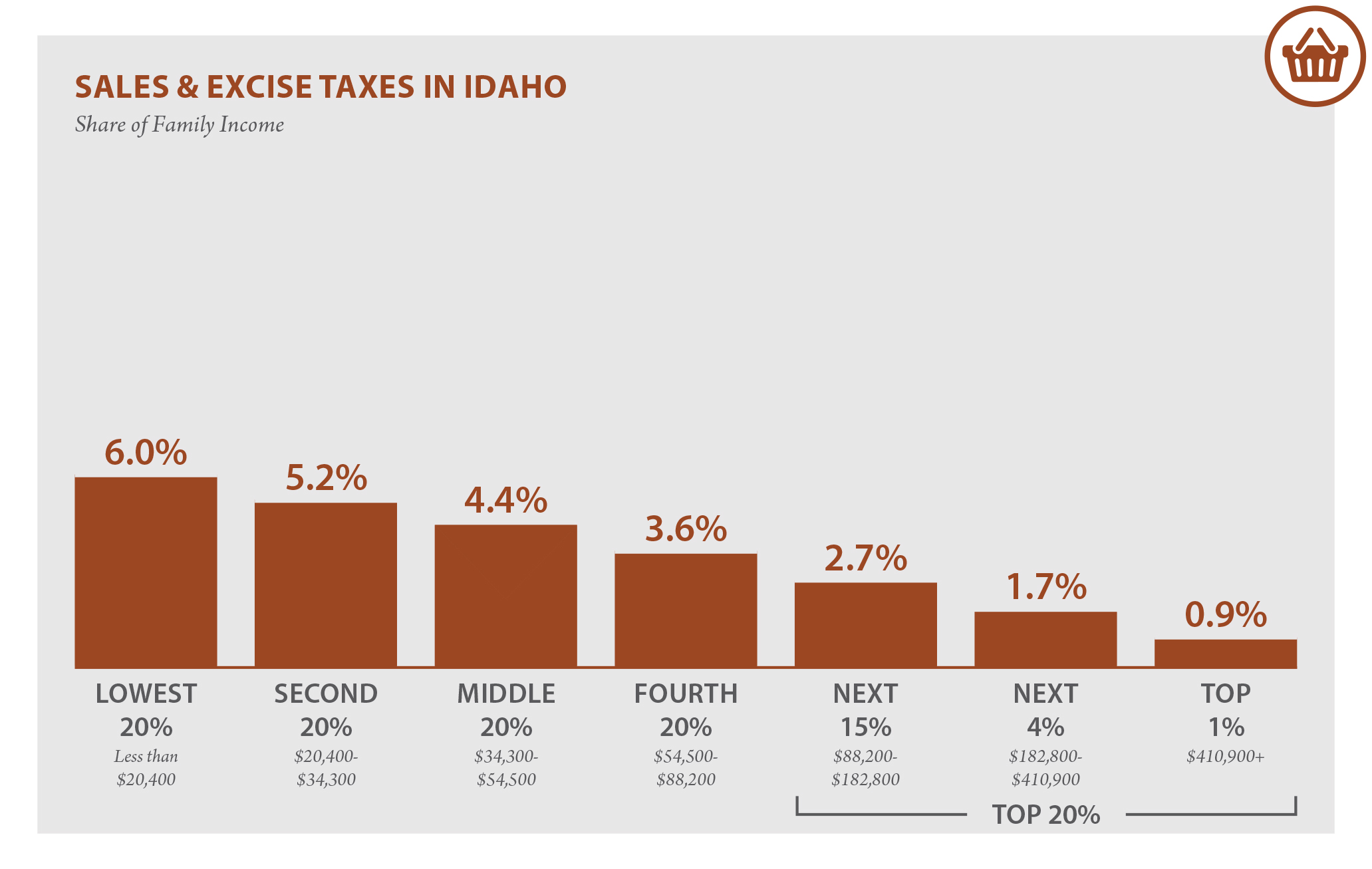

Idaho Who Pays 6th Edition Itep

In Many States You Pay Sales Tax On Items You Buy This Sales Tax Is A Percent Of The Purchase Price A Tax Percent Is Also Called A Tax Rate A Desk

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Idaho Ranks 21st In The Annual State Business Tax Climate Index Stateimpact Idaho

Idaho State Tax Guide Kiplinger

2013 April Stateimpact Idaho Page 2

Idaho State Tax Return Etax Com

Sales Tax Rates Wine Software By Microworks

Sales Taxes In The United States Wikipedia

How High Are Sales Taxes In Your State Tax Foundation Of Hawaii

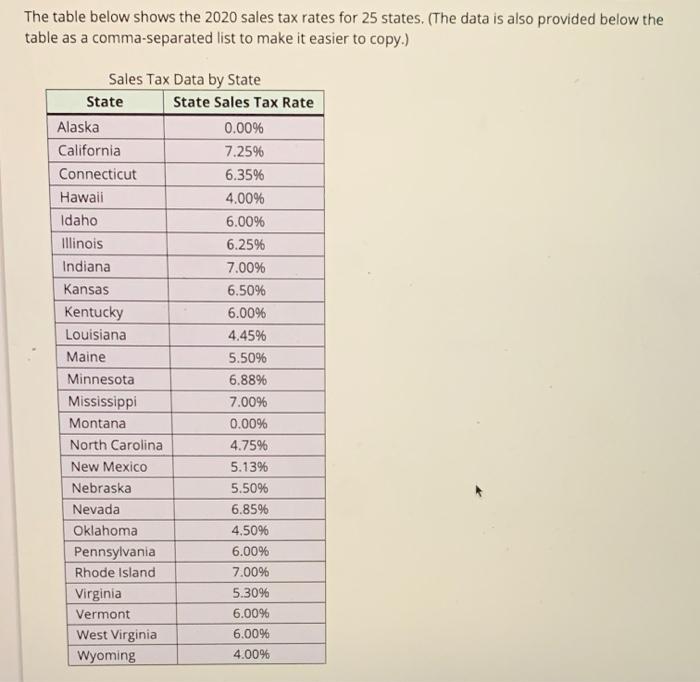

Solved The Table Below Shows The 2020 Sales Tax Rates For 25 Chegg Com

State Sales Tax On Groceries Ff 09 20 2021 Tax Policy Center